U.S. Treasury Bolsters Economy with Increased Issuance of Long-Term Government Debt

- Sam Golder

- Aug 2, 2023

- 3 min read

In response to the economic challenges of recent years, the United States Treasury has taken decisive action to bolster the economy by increasing the issuance of long-term government debt. This strategic move aims to address various economic concerns, ensure stability in financial markets, and support long-term growth prospects. In this blog post, we will delve into the significance of the Treasury's decision, explore its potential implications, and analyse the benefits it offers to both the government and the nation's citizens.

Knowledgeability behind the Treasury's Decision

The United States Treasury Department plays a pivotal role in managing the nation's finances. One of its key functions is to issue government debt to fund various programs and initiatives. Traditionally, the Treasury has relied on short-term debt instruments like Treasury bills to meet its funding needs. However, given the unique challenges the country has faced, a shift towards issuing long-term government debt has gained traction.

The Rationale Behind Long-Term Debt Issuance

To begin, capitalising on interest rates at historically low levels, the Treasury's move to increase long-term debt issuance capitalizes on the favourable borrowing environment. Locking in these low rates over an extended period can save billions in interest costs over time, reducing the burden on future taxpayers.

Secondly, Strengthening Market Stability. This is completed by increasing the supply of long-term debt, the Treasury can meet the growing demand from investors seeking secure and predictable income streams. This can therefore foster market stability, mitigating potential volatility during uncertain economic times.

Finally, supporting fiscal policy Initiatives is beneficial. This is often endeavoured by allowing additional funds raised from long-term debt issuance to help support these various fiscal policy initiatives aimed at bolstering economic growth, improving infrastructure, and investing in critical sectors like healthcare, education, and technology.

Implications of Increased Long-Term Debt Issuance

Impact on Federal Budget Deficit

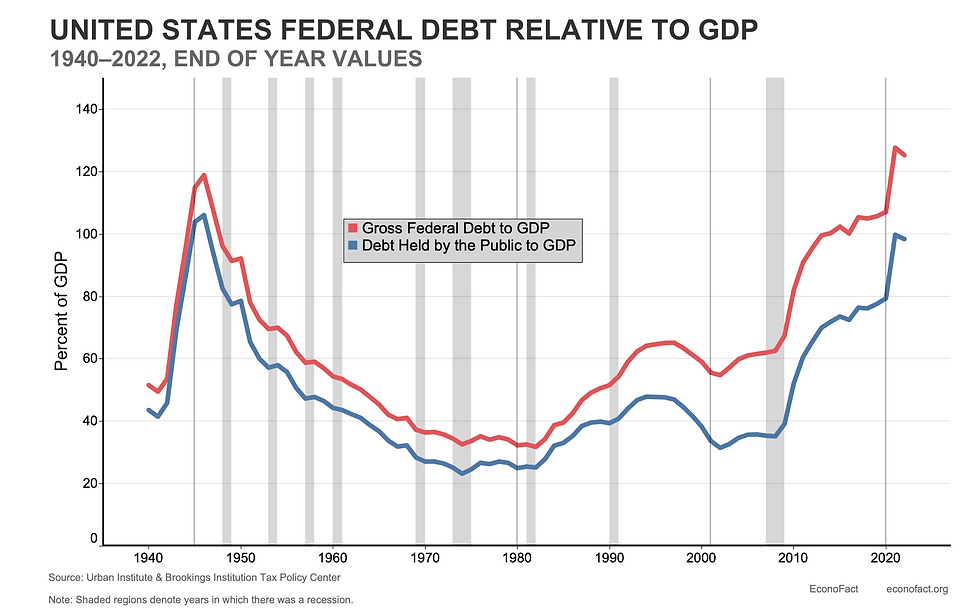

While the issuance of long-term debt can support essential government spending, it also contributes to the federal budget deficit. The Treasury must strike a balance between stimulating the economy and maintaining fiscal responsibility to avoid an unsustainable accumulation of debt.

Effect on Interest Rates

As the Treasury increases the supply of long-term debt, it may have an impact on interest rates, particularly for longer-dated maturities. Although low-interest rates are favourable for borrowers, they can also influence inflation and monetary policy decisions.

Long-Term Economic Growth

Investing in projects and initiatives through long-term debt can yield significant long-term benefits for the economy. Funding infrastructural improvements and research and development can lead to increased productivity and economic growth over time.

Benefits to Citizens and the Economy

Funding crucial projects through long-term debt issuance can create job opportunities across various sectors, promoting economic resilience and stability.

Moreover, increased government funding can lead to improvements in social services, education, and healthcare, ultimately enhancing the overall quality of life for citizens.

Finally, the U.S. government's commitment to responsible fiscal management through long-term debt issuance can attract foreign investors, bolstering confidence in the economy and creating a positive ripple effect on investments.

Overall, The United States Treasury's decision to boost the issuance of long-term government debt marks a strategic move aimed at supporting economic growth, enhancing market stability, and addressing critical social and infrastructural needs. By harnessing historically low-interest rates and responsibly managing the budget deficit, the government seeks to secure a prosperous and resilient future for its citizens. However, prudent fiscal management remains paramount to ensure that the benefits of increased long-term debt issuance continue to outweigh any potential risks.

By Samuel Golder

Founder and Editor

Comments